[ad_1]

The first quarter of 2020 will be remembered as a period when the coronavirus-led uncertainty set off a liquidity crisis in financial markets, forcing investors to sell everything, including bitcoin (BTC).

The top cryptocurrency, often touted as a safe haven, fell by 10 percent in the first three months of 2020.

While the cryptocurrency eked out 30 percent gains in January amid the U.S.-Iran tensions, it could not withstand the bearish pressures emanating from the global dash for cash in March.

The broader crypto market also suffered losses in the first quarter, as evidenced from the 5 percent decline in the total market capitalization, according to TradingView.

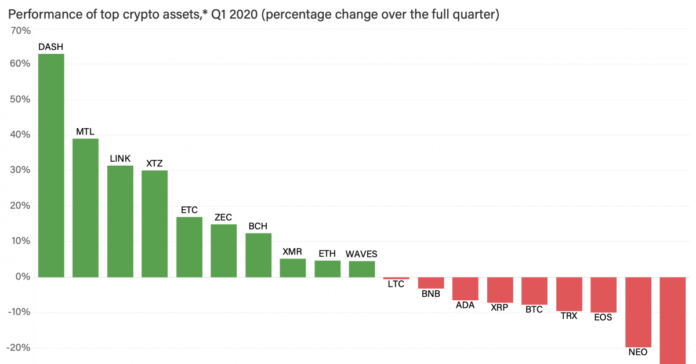

However, a few cryptocurrencies including the privacy coin dash and link, the native token of decentralized oracle network Chainlink, managed to put in a positive performance. Even the most actively traded cryptocurrencies have thin volumes compared to traditional assets like stocks and bonds, so ascribing market movements to fundamentals remains a tricky exercise in this young, speculative market. However, developments such as evidence of real-world adoption or new business partnerships may have played a role in these coins’ gains.

See also: How Financial Models Could Move Bitcoin’s Price After the Halving

The following are notable winners and losers of the first quarter among 19 major assets featured in the forthcoming CoinDesk Quarterly Review. The list is curated to exclude cryptocurrencies with less than 12 months of trading history, and daily trading volume of less than $5 billion. The list does not include stablecoins. CoinDesk Research will publish the Q1 edition of the Review this month.

Winners

Quarterly performance: +63 percent

Rank by market capitalization: 19

Market capitalization: $606 million

Dash (dash), the 19th largest cryptocurrency by market capitalization, jumped nearly 63 percent to register its best quarterly performance since the final quarter of 2017, according to data source Messari Pro.

Back then, the privacy-focused cryptocurrency had rallied by a staggering 217 percent amid the bull market frenzy in the crypto markets.

The latest quarterly gain is largely the result of January’s stellar 180 percent price rise. While the majority of prominent cryptocurrencies outperformed bitcoin’s 30 percent rise in January, dash went a step further by scoring triple-digit gains, possibly due to increased adoption in Venezuela’s hyperinflated economy.

“Dash established meaningful collaborations with international brands including Burger King in Venezuela and Germany. These collaborations, coupled with lower transaction costs and a faster transaction experience than bitcoin, further promote dash’s narrative of day-to-day usability,” said Nemo Qin, an analyst at brokerage eToro.

The team behind dash has certainly been pushing that narrative. “Venezuela is now the world’s leading market for crypto adoption,” Ernesto Contreras, the chief of the Dash Core Group, declared in a blog post on Jan.11.

See also: Bitcoin All-Time High in 2020? Chances Are Only 4%, Options Market Signals

Some observers, however, challenged the dash community’s claim of massive adoption, accusing the cryptocurrency’s Venezuelan team of fabricating merchant usage numbers. Peter McCormack, host of the What Bitcoin Did podcast, said in February that Dash was exploiting Venezuela with propaganda. Ryan Taylor, CEO of Dash Core Group countered skeptics with a detailed post outlining dash’s increasing usage in Venezuela.

Taylor’s assurances, however, did not stop the cryptocurrency from taking a hit in February and March alongside sharp losses in bitcoin. The cryptocurrency fell 23 percent in March, but still ended the quarter with outsized gains.

Quarterly performance: +31.5 percent

Rank by market capitalization: 14

Market capitalization: $2 billion

Link, the 14th largest cryptocurrency, closed the first quarter with 31.5 percent gains, having put in dismal performances in the preceding two quarters.

At one point, in early March, the native cryptocurrency of the Chainlink network was trading at record highs above $5.00, representing a staggering 200 percent year-to-date gain.

“Chainlink is benefitting from the shift in focus from base layer smart contracts like Ethereum to oracles, which began in 2019,” Vance Spencer, co-founder of Framework Ventures, a blockchain technology company, said in early March.

A decentralized oracle network built on top of Ethereum, Chainlink connects smart contracts to real-world data, events and payments. An oracle is a third-party information source, whose sole purpose is to supply data to blockchains. So for example, if two users bet on the outcome of a soccer match, the oracle will tell the smart contract which team won, so it can pay the winning bettor.

Chainlink has made encouraging noises over the last 12 months or so with multiple partnerships that look like the product of relentless business development and go-to-market strategy, as noted by Spencer Noon, head of crypto investments at DTC Capital.

Recently, decentralized finance (DeFi) platform bZx integrated Chainlink’s solutions recently following the major hack in February. Meanwhile, Celsius Network, a crypto lending and borrowing platform, announced on Monday that it has entered into a partnership with Chainlink to strengthen the security and reliability of its services.

Losers

Quarterly performance: -39 percent

Rank by market capitalization: 36

Market capitalization: $262 million

VeChain’s VET token fell by 39 percent in the January-March period, erasing the rise from $0.0035 to $0.0055 seen in the final quarter of 2019.

The first quarter began on a positive note, with the cryptocurrency rising 10 percent in January. The gains, however, were significantly less than the broader market, as indicated by the total market capitalization, which rose by 35 percent.

VET remained on the back foot in February, having underperformed in the first month, and took a beating in March as the broader market collapsed with the sell-off in bitcoin. The cryptocurrency hit a record low of 0.0014 on the Binance exchange on March 13 and ended the month with a 43 percent loss.

VeChain is a blockchain-enabled platform designed to enhance supply chain management processes and has a strong presence in China. The coronavirus outbreak in China in January and February and across Europe and in the U.S. in March hurt VeChain’s business activity. However, no projects were canceled due to the pandemic, according to a VeChain Foundation blog post.

The foundation announced on March 31 about a collaboration with Shanghai Gas (Group) Co., Ltd, a wholly-owned subsidiary of Shenergy Group Company Limited with registered capital of 4.2 billion renminbi ($57 million), to develop a blockchain-enabled energy project.

Quarterly performance: -20 percent

Rank by market capitalization: 22

Market capitalization: $631 million

NEO (NEO), which fell 20 percent in the first quarter, is also based in China. The sentiment around “China’s Ethereum” had turned bullish in the final three months of 2019, mainly due to President Xi Jinping’s decision to embrace blockchain technology.

The cryptocurrency rallied 14 percent in the October to December period, despite bitcoin’s 13.6 percent drop, only to surrender gains in the first quarter of 2020.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

[ad_2]